This post is also available in: Français (French)

The meeting of finance looking to be more sustainable, #BuildingBridges23, took place. I had the pleasure of talking and giving a speech in the Village. My takeaways:

➡️ #Nature was the buzz word of the day, proving that Swiss finance is on board with corporate biodiversity/nature. Which is motivating! Pioneer financial institutions FIs have already provided valuable lessons that could be more visible among the events. See our pitch on the takeaways from French FIs (see BioPerf.biz mention below).

➡️ Capacity building will be key for FIs to walk the talk. The bridges between ecology trained specialists and banks still need to be built. Climate was misleading in this regard.

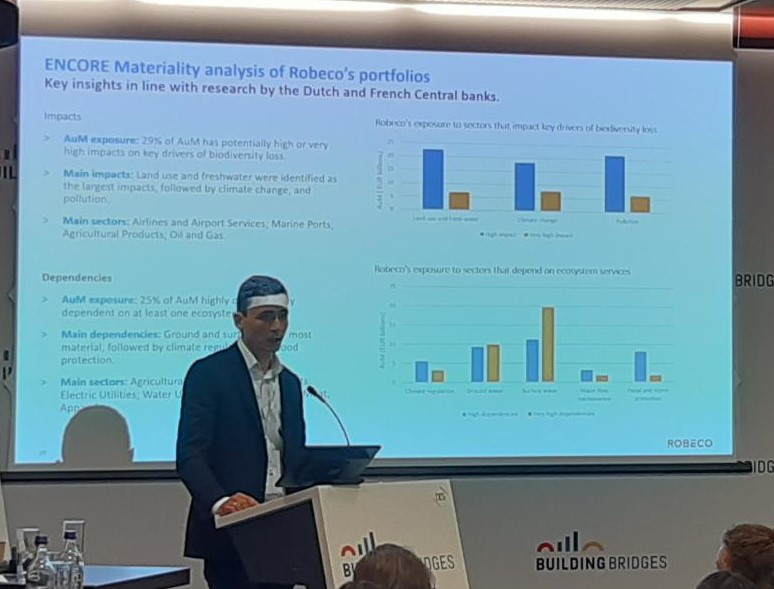

➡️ The ENCOREtool remains the go-to for assessing biodiversity-related impacts and dependencies (see Robeco assessment below). Lack of information and reluctance to engage budget may prevent other solutions based on licensed software from being adopted.

➡️ There is no consensus around biodiversitycredits, which is comforting. Some early birds will start to offer these products, but years will be needed before there are credible standards.

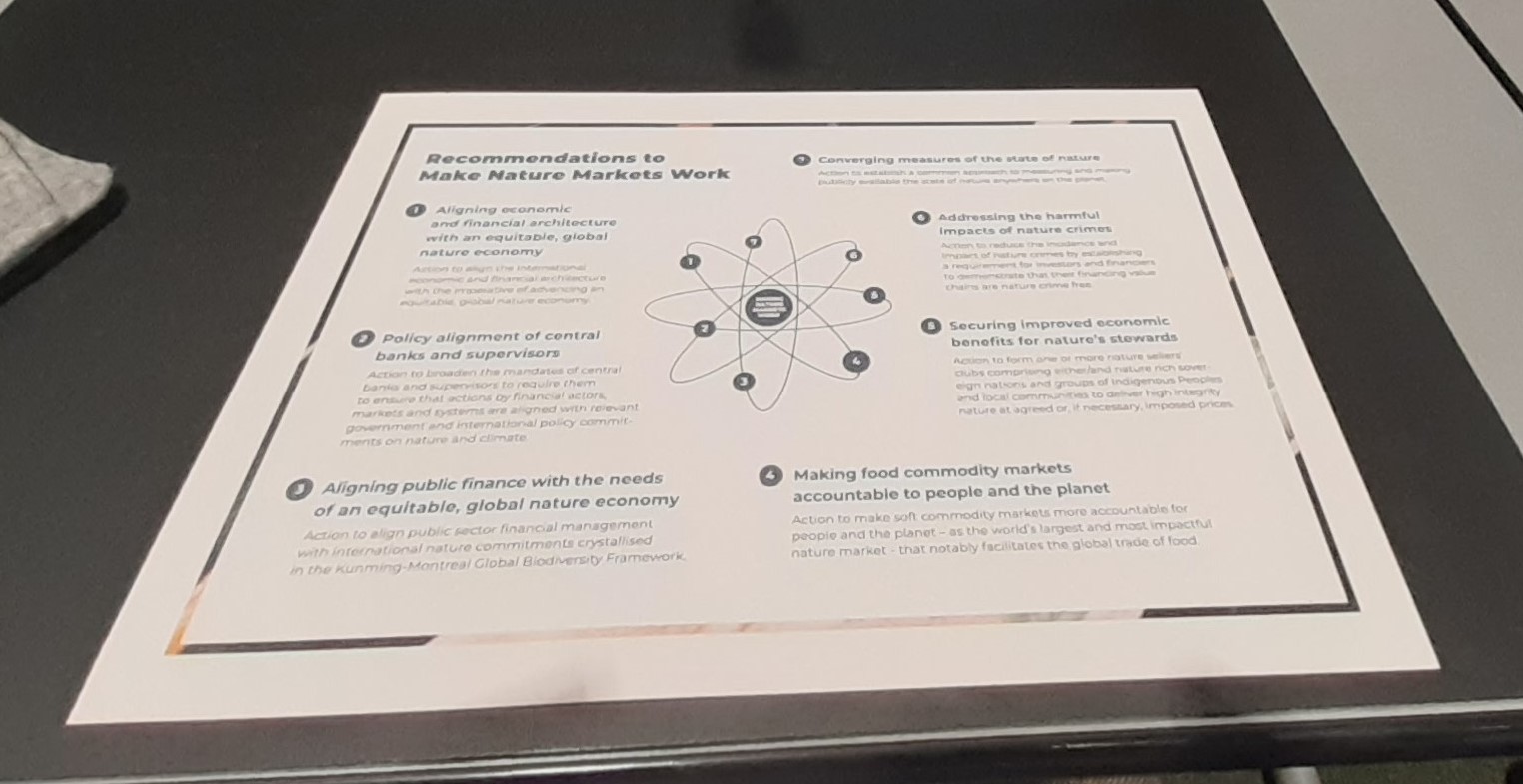

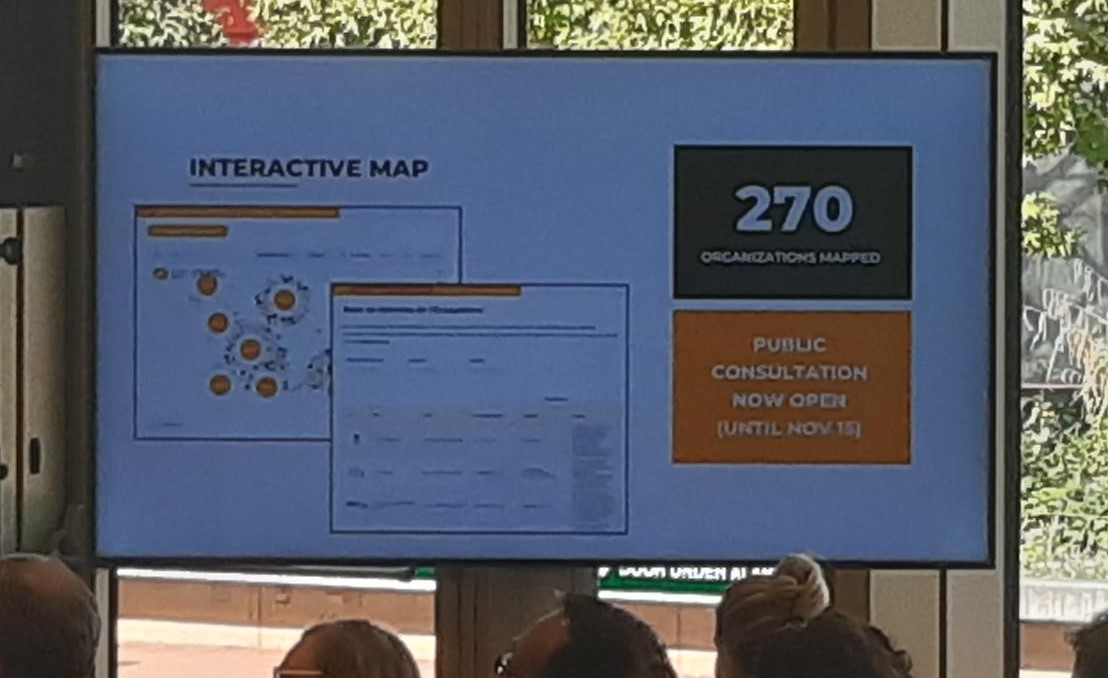

➡️ A naturepositive future requires innovation beyond silos (see NatureFinance map below). The credibility of FIs commitments will be secured by science-based approaches, stakeholder engagement and outcomes. FIs cannot hide behind a backstage role.

➡️ The program was quite dense, and even lasting 3 days, it may require more focus on specific topics. The opportunity for Geneva to build up a strong position in nature-related finance is huge, with big players, long-standing finance skills, world class research centers and an incredible conservation history (see SFG – Sustainable Finance Geneva map below). Let’s see how this event develops next year!

🙏to my colleague Fanny Bancourt (BL évolution partner) for the support in preparing this day. And to all the people I met there.

Recent Comments